In today’s article, I will talk about the history of cryptocurrency, how cryptocurrency was invented, different milestones in cryptocurrency, why crypto is so popular, and the future of cryptocurrency.

All my regular readers already know something about crypto, and since last month I have been regularly posting articles on how to earn cryptocurrency. Many of you comment on me and are willing to know about the history of crypto in detail. That’s why I am going to write cryptocurrency details history today.

Table of Contents

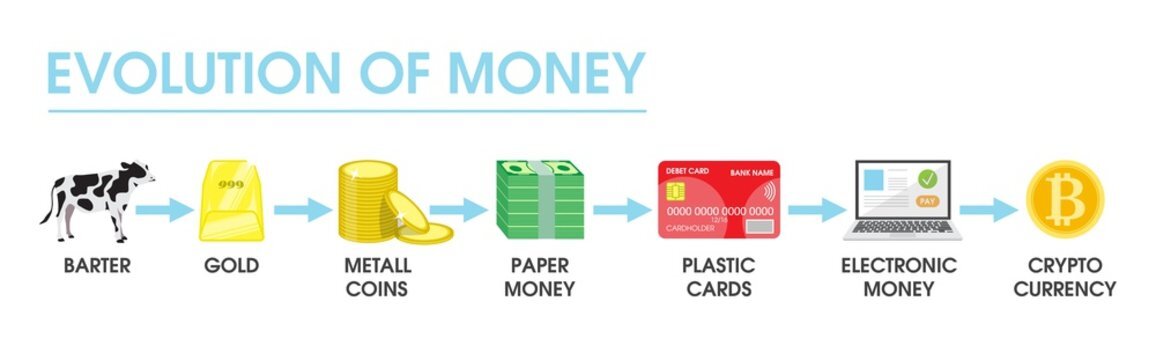

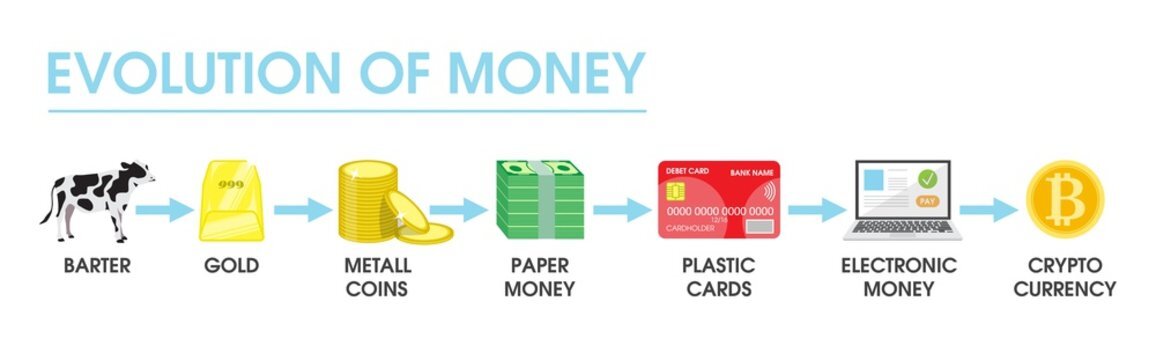

History of Normal Currency

Before knowing about the History Of Cryptocurrency, we need to know details about currency. When was the currency system started? No one knows the exact answer to this question. But on research, “Mesopotamian shekel” was the first know currency in the world that use in 5000 years ago.

Barter System

All we know is that human history is not only 5000 years, so how did people trade before that? How do people buy goods that they need for daily living? Early humans exchanged things with other people and ran their everyday life.

For example, I need rice, but I have meat, so I am searching for people who need meat and already have rice for exchange. Fulfilling each other’s needs by exchanging goods and services is called the barter system, and the barter system also exists in today’s world.

While using the barter system, people face many problems while exchanging challenges to find familiar interest people. For example, I have rice, and I need fruits in exchange, and the second party needs rice, but they have something else rather than fruits. Due to difficulty in finding the same interest people and lack of precise valuation of both party goods, this system is overridden by commodity exchange.

Commodity Exchange System

Commodities are essential items that every people needs, like salt, sugar, cotton, milk, etc. ( all agricultural products and raw materials). Every people needs commodities items, and it is more feasible to exchange goods and services. Commodity exchange solves the problems of the barter system but also raises other significant issues like transport and store. So commodities exchange is not suitable for everyone, and the concept of the coin is started.

Coin Currency

People can store coins for a long time and can easily travel, bringing coins along with them. In ancient times coins were made up of precious metals and had values equal to that metal value during the exchange. Lydian Kingdom created and used the first coin currency in western culture in 700 BC, which is in Turkey now, with a specific price and helps in exchange quickly. By the use of coins, people can easily exchange/buy goods and services. After in tradition of coin making precious metal is hard to find, then coins are made from any metals that are easily found in our locality. Creating coin currency is expensive, then the concept of paper money is started.

Paper Money

Paper money was first developed by Tang dynasty china during the 7th century, but paper money did not appear until the 11th century during the rule of Song dynasty China. After that, the paper’s current tradition is spread throughout the Mongol Empire. But in European culture, paper money started in the 11th century and was abundantly used after the 17th century. In ancient times paper money was called representative money that means paper money is just a receipt for gold/silver price.

Paper money is proof that the holders have particular gold/silver and easily trade up to their gold/silver without any restriction. Nowadays, money is not backed by Silver/gold. Present world currencies are called fiat money regulated and maintained by government authorities and not supported by any silver/gold. Unlike commodity-based money like gold, silver, copper, fiat money is more stable and easy to control and regulate. Without government approval, fiat money has no value. Fait money possesses value only after the signature of the central bank’s governor.

You might be confusing that why I am talking about history and the system of standard currencies through the topic is the history of cryptocurrency. Don’t worry, and I will be right there into the topics quickly.

Also read: Top 10 Highest Salary Paid Countries in The World 2022

History Of Cryptocurrency

Although the first cryptocurrency is bitcoin and was created in 2009, various individuals and groups work on cryptocurrencies. David Chaum is known as a pioneer in the crypto industry. He is one of the first cryptographers, who tried to change the thousand-year-old cryptography history to the next level by trying to implement it on the currency system.

Many of us don’t know how long cryptography history exists in the world; most of us know the cryptocurrencies after the invention of Bitcoin. Now today’s article, I am going to explore the history of cryptocurrency in detail.

Around 1900 BC: Ancient Use of Cryptography

Cryptography is not a new word to the world. Cryptography has existed in our community since ancient times. There are various opinions as to who started cryptography? And when cryptography invested? It is believed to have been first used by the Egyptians around 1900 BC encrypting by hieroglyphic characters instead of familiar and readable characters. That hieroglyph code is only read and understood by the Scribes who write and send the messages on behalf of their emperor.

Now let’s back to the main topic that is the History Of Cryptocurrency. Cryptography was invented to make two parties’ deals and communication secure. The first recorded cryptography used is a Cipher device that military commanders use for secret communication. While talking about cryptography and its history, it is taken along, so if you need to know more about cryptography and its history, please comment on us.

Early 90’s History Of Cryptocurrency: Advancement in traditional cryptography

Various names contribute to the advancement of traditional cryptography and lead toward the present crypto implementation. Claude E. Shanno, One Leon Battista Alberti, Giovanni Battista Della Porta, etc., are some renowned names that contribute to cryptography. All credits go to these people for the present implementation of cryptography.

1982- 2008: Starting of Modern Cryptographic System ( Cryptography implementation on Currencies)

David Chaum( Cryptographer) is the first person that works on virtual coins. He is a Cryptographer and computer scientist from America. The first known proposal for a Blockchain protocol was David Chaum’s dissertation ( original research-based academic paper) in 1982. After his dissertation, America developed eCash based cryptography system. He is continuously working on a confidential transaction system, and after 12 years, he developed a cryptography-based secure payment system called DigiCash.

To date, cryptography is used to secure digital payment, but the term “Cryptocurrency” was introduced by Wei Dai in 1998. Wei Dai thinks about the concept of cryptocurrency with decentralized features, and he contributes to the development of bitcoin and ether also.

Although bitcoin was the first known cryptocurrency before that, there were some attempts to create ledger encrypted cryptocurrencies that never success. B-Money and Bit Gold were the two examples that were formulated but not fully developed.

2008: Question on Centralized system and Raise of Decentralized System

Fait money financial system is based on a Centralized system. The Fait system is based on trust in the government and central bank. All the fiat money is controlled by the government and central bank with the help of a centralized system. All the decisions related to the printing of money, circulation, monitory policies are managed by the government and central bank.

Now let’s take one example, we are opening an account in the bank for saving. The bank manages our money and pays some interest on our savings. All the banks are controlled and governed by Center bank, so we trust the bank. If banks invest our money without analyzing the risk and banks lose our money, then who will be responsible? This is the main question who is responsible?.

I am going to clarify the above example with a real-life incident. Most of us already know about the USA 2008 financial crisis. In 2008 banks were providing risky loans for getting new customers, which will convert to bad debt. Due to this, many banks are collapsing, and the customers are losing their savings also. American government offered some money to the banks to overcome the bad debt.

All we know is that the money of government is ultimately the money of citizens that citizens paid to the government in the form of tax. So the trust in the government and the central bank is broken. Due to the 2008 financial crisis, not only in the USA, but the whole world economics was also unstable.

And then, the decentralized currencies system was the main topic discussed around the world. Many individuals and groups of individuals discuss and work on the decentralized system again. After that group of people says that “the money earn by the citizen’s hard work is solely the property of that citizen, government and the central bank has no right to control and regulate.”

2008: Pseudonymous Person or Group – Satoshi Nakamoto

Satoshi Nakamoto posted a Bitcoin-Peer to Peer Electronic Cash System paper on the mailing list cryptography discussion group, this is the major milestone in the History Of Cryptocurrency. No one knows who Satoshi Nakamoto is; Satoshi may be an individual or group of individuals, the real identity is still mysterious to the world. Satoshi releases a white paper on Bitcoin P2P electronic cash system after the US financial crisis; while writing the white paper, he references eight more resources from different researchers like W. Dai, H. Massias, R.C. Maerkle, S. Haber, D. Bayer, W. Feller, and A. Black as per his white paper reference section.

In his paper, he proposes such a financial system on which we have control of our funds. Our funds are not controlled and managed by the central bank and government. In order words, he proposed the concept of the decentralized P2P transaction system. The Bitcoin.org domain was registered in the same year, and Satoshi Nakamoto’s white paper was published on the website.

2009: First Step on Crypto

The bitcoin opensource software is ready and launched for the public for the first time. Initially, people can start mining, and the whole process is recorded and verified on the blockchain begins; this is the first significant step/milestone in the journey of Bitcoin and the overall history of cryptocurrency. The first bitcoin transition also occurred in 2009 when Satoshi sent ten bitcoin (BTC) to Hal Finney, a computer programmer, on 12 January. The first mining block was also recorded in 2009 and is known as Genesis Block before Satoshi sent 10 BTC to Hal Finney.

At the end of the year, the new Liberty Standard publishes the exchange rate for Bitcoin. In December, Satoshi Nakamoto released the second version of the software. At that time, people could buy 1309.03 BTC for $1 ( that is 0.000764 USD for 1 Bitcoin); this was the all-time low BTC price in history.

2010: First Bitcoin Transaction for Service/Goods

On 15 august bitcoin system was hacked, which shows the major vulnerability in the system. One hundred eighty-four billion bitcoin unusual transaction is detected, and this transaction is noted by bitcoin developer Jeff Garzik and said publicly that ” We have had a problem here.” After fixing this issue number of users mining and trading increases.

Bitcoin gets popularity as the first decentralized cryptocurrency in the world. There is no real-world transaction of bitcoin; all the bitcoin holders use bitcoin as an online asset and are involved in trading and mining only. In late 2010 first bitcoin real-world transaction took place when a person in Florida bought a couple of pizzas for 10,000 Bitcoin. It would be more than $ 550 million at the current prices, enough to buy a pizza franchise hundreds of times. Although the buying pizza decision is not suitable for him, it gives some monetary value to Bitcoin and lifts the cryptocurrency potential in the history of Cryptocurrency.

2011: Rise of Altcoins

After the successful operation of Bitcoin, other developer thinks over the alternative of bitcoin and the altcoins such as Litecoin, Swiftcoin, and Namecoin. Initially, Litecoin was considered the biggest competitor of bitcoin because of its new algorithm that makes it a cheaper and faster transaction than Bitcoin. But the king is always remains king; the bitcoin price is Skyrock after the emergence of alternatives. In February, BTC crossed its 1 cent threshold, and after that, Bitcoin was worth $1 for the first time in the history of Cryptocurrency. All we know is that the price of Litecoin is far lower than the bitcoin on today’s date (1 LTC = $ 202 while writing).

After increasing the popularity of bitcoin, bitcoin was featured in TIME magazine for the first time. Same year bitcoin is frequently used in the dark web drug market, June Bitcoin worth crosses over $30 and soon crash back down to $10.

Also read: FaucetPay Review: Earn Free Crypto and Micro Wallet

2012: Cross $100 Threshold | Halvening | Staking

In 2011 bitcoin prices fluctuated, sometimes high and sometimes crashed back, but in 2012 BTC prices continuously and steadily increased and crossed their $100 threshold in April. And year 2012 is also a milestone year in cryptocurrency history because the first halving occurred in 2012. The process of cutting into the half after reaching specific criteria is called halving. On Bitcoin, according to white paper and algorithm, the halving process occurs when mining goes to 210,000 blocks and so on. The next halving happened in 2016, and the following halving is late 2020. Halving is necessary to maintain the amount of Bitcoin available because a finite number of bitcoin exist.

After halving, mining rewards were lesser than the previous, and it was less profitable to mine comparatively in the last years. Then in 2012, Paper for Peercoin was introduced; according to Paper for Peercoin, people can stake their coins and earn from staking.

The world’s most popular crypto exchange Coinbase was also launched in 2012. The exchange and wallet were founded by two founders named Fred Ehrsam and Brian Armstrong. And in 2014, coinbase reached 1 million users and was also one of the top 10 most significant crypto exchanges in 2021.

2013: Crosses $1000 | Raising of DogeCoin

On continuous ups and downs, Bitcoin price crosses $1000 thresholds for the first time in the history of cryptocurrency and gets more public recognition. Bitcoin change specific rules regarding transactions, and the holders disagree, which lead to a fork on blockchain. I mean, blockchain was split into two parts and lasted for six-hour hours with two operating networks in parallel, which led to a significant drop in the price of Bitcoin. At the same time, various countries like Thailand, China banded Bitcoin and declared it an illegal activity. But At the same time, Canada launched the first bitcoin ATM in Vancouver.

In late 2013 Dogecoin was launched, and within a month, Dogecoin.com had over 1 million visitors. Initially, Dogecoin was launched as a joke, but now in 2021, it grows over 20,000% within a year.

2014: Mt. Gox Scam | Microsoft receive Bitcoin for games purchase

Mt. Gox, Japan, based world’s largest crypto exchange in 2014, was bankrupt and shutting down. Due to Mt. Gox’s down 850,000 bitcoin was lost by different investors, and they never got back their funds. Those lost coins are worth around $50 billion at today’s rate (while writing this article).

In 2014 blockchain 2.0 was launched, which is Ethereum blockchain, which also refers to smart contracts. On the other side due to the popularity of Bitcoin, Microsoft allows people to buy the game with bitcoin.

2015: Rise of Ethereum

Although the developer launched Ethereum blockchain in 2014, the Ethereum coin got famous in 2015. And today date Ethereum is the second-largest cryptocurrency after Bitcoin in market capitalization. Many people take Ethereum as the strongest competitor of Bitcoin. On the other side, Europe base bitcoin exchange Bitstamp is hacked but resumes trading after a few days and assures all their customers that their funds are still safe.

2016: Ethereum ICO | Fork in Ethereum | Second halving

Cryptocurrencies are getting more popular day by day. There is a remarkable rise of Bitcoin ATMs; at the beginning of 2016, there were 500 Bitcoin ATMs and reached 900 plus at the end of 2016. Uber accepts bitcoin payments in Argentina. Ethereum comes with blockchain-based smart contracts and apps. Ethereum started ICO (Initial Coin Offerings) in 2016 and was one of the most significant crowdfunded projects in 2016. The word “Smart Contract” is first introduced by Ethereum.

Later Ethereum was hacked after a month of its launch; as a result, a fork occurred on Ethereum, also similar to the bitcoin fork. Due to this, Ethereum splits into Ethereum classic and Ethereum. Bitcoin continuously grows due to its second halving and moving on positive trends.

2017: Booms in Bitcoin | Fork on Bitcoin

All we know is that someone bought two pizzas for 10,000 BTC in 2010. Why do I am repeating the same things that I am telling you previously? Because this year, Bitcoin hists $10,000 a long way from 2010. In 2010 someone bought two pizzas for 10,000BTC, and now in 2017, the price of 1 BTC is $10,00 interesting to hear it. Now the BTC is the primary choice of new and early investors, which will support the BTC price growth after the previous halving in 2016. Many people are interested in searching for cashout funds in monetary currency to address the demand many financial institutions and governments legalize cryptocurrencies in their territory.

Halving is the main reason that leads to the fork on the bitcoin network. After the second halving in 2016, it was more difficult to mine bitcoin; many users were trusted due to more time, resources, and electricity costs while mining the same amount of BTC as previously. In August, two different users’ mindsets split the bitcoin network into two coins, Bitcoin (BTC) and Bitcoin Cash (BCH). According to its market capitalization, Bitcoin Cash is the 22nd most prominent Cryptocurrency today ( on the day of writing this article).

2018: Big Crash on Crypto Market | Rise of Ripple

According to the statistics, the whole crypto market dropped over $800 billion to $460 billion from 2018 to Mid January, including more than 1400 crypto assets. The price of the world’s largest Cryptocurrency, Bitcoin, declined by 67%, which is the all-time highest dropping price in the history of Cryptocurrency.

On the other hand, various European governments collaborated and launched the innovative project, Ripple. And the same year, Samsung confirmed that they are making chips that help in mine.

2019: Commercialization of Crypto | Facebook Enters to the Crypto Market

After the paper release by Satoshi, a large population, adopt cryptocurrencies, and commercialization occurs. Multiple organizations and shops accept crypto as their payment methods. However, some countries like Algeria, Bolivia, Egypt, Nepal, Vietnam, etc. that declared crypto as an illegal currency and band on their territory. Due to the increasing popularity of Cryptocurrency, many ICOs and IDO are coming, and the new crypto assets are emerging day by day. Facebook also announced to launch their crypto coins initially termed “Facebook Coin,” or “GlobalCoin.” In July 2019, Facebook officially named “Libra,” but in 2020, Facebook rebranded it as “Diem,” and Diem is waiting to be launched after getting regulatory approval.

2020: Cryptocurrency Lending

Crypto Lending concept is not a new concept, but lending gets popularity due to the economic crisis in 2020 due to the world’s largest pandemic. People need fast cash, and crypto lending companies give fiat currencies on cryptocurrency loans, which will generate new ways to create passive income if you already have some cryptocurrency.

2021: $2 Trillion Market Capitalization | Crypto as Country legal Tender

Till 2021 total crypto market capitalization crosses $2 Trillion, and these statistics will grow and break own records and maintain new records. Currently, there is more than 7000 cryptocurrency, according to Coinmarketcap data, and new crypto assets are emerging day by day. Till the date of writing, Bitcoin has remained the king of cryptomarket. Some countries recently legalized and made Bitcoin their country’s legal tender. El Salvador is the first country who make bitcoin a country legal tender by passing the bills from their Legislative Assembly. And after that, Cuba also makes bitcoin their country’s legal tender.

In 2021, cryptocurrency continued its trajectory of growth and mainstream adoption. The year began with Bitcoin reaching an all-time high of over $64,000, with other cryptocurrencies such as Ethereum and Binance Coin also reaching new highs. However, the market experienced a significant downturn in May, with Bitcoin losing over 50% of its value. This was attributed to factors such as regulatory crackdowns in China and environmental concerns over Bitcoin mining.

Despite the downturn, the cryptocurrency market rebounded later in the year, with Bitcoin reaching a new all-time high in November. In addition, there was a significant increase in institutional adoption, with companies such as Tesla, MicroStrategy, and Square investing in Bitcoin. There was also an increase in the use of cryptocurrencies for payments, with companies such as PayPal and Visa announcing plans to support cryptocurrencies.

However, the year was not without controversy. The cryptocurrency industry faced regulatory scrutiny in many countries, with China banning cryptocurrency mining and trading, and India considering a ban on cryptocurrencies altogether. In addition, there were several high-profile hacks and scams, such as the Colonial Pipeline ransomware attack and the Poly Network hack.

Overall, 2021 was a year of both growth and challenges for the cryptocurrency industry. The market continues to evolve and mature, with increasing institutional adoption and regulatory scrutiny shaping its future.

2022: Overall Growth

In recent years, the cryptocurrency industry has experienced significant growth and adoption, with an increasing number of individuals and institutions investing in cryptocurrencies. However, the industry has also faced regulatory scrutiny and a range of technical and security challenges.

One significant development in the industry was the growing institutional adoption of cryptocurrencies, with companies like Tesla, MicroStrategy, and Square investing in Bitcoin. Additionally, several major financial institutions, including JPMorgan and Goldman Sachs, announced plans to offer cryptocurrency-related products and services.

At the same time, there were also several high-profile hacks and scams that highlighted the need for increased security measures in the industry. For example, the Colonial Pipeline ransomware attack and the Poly Network hack both demonstrated the vulnerability of cryptocurrency infrastructure to cyberattacks.

In terms of regulation, several countries took steps to address the growing use of cryptocurrencies. China, for example, cracked down on cryptocurrency mining and trading, while India proposed a ban on cryptocurrencies altogether. At the same time, other countries, such as El Salvador, took steps to embrace cryptocurrencies, with the country becoming the first to adopt Bitcoin as legal tender.

Overall, the cryptocurrency industry remains dynamic and rapidly evolving. While the industry has experienced significant growth and adoption in recent years, it also faces ongoing challenges and uncertainty related to regulation, security, and market volatility.

2023: Overall Growth

Governments around the world are continually working on regulations for cryptocurrencies. Keep an eye on updates from major economies as they may influence the adoption and use of cryptocurrencies. Blockchain and cryptocurrency projects often introduce new technologies and improvements. Look for updates on major blockchain platforms, consensus algorithms, scalability solutions, and privacy features.

Keep an eye on developments in decentralized finance (DeFi) and non-fungible tokens (NFTs), as these areas have been rapidly evolving and gaining popularity. Many central banks are exploring or developing their digital currencies. Updates on Central Bank Digital Currencies (CBDCs) projects and their implications for the broader cryptocurrency space can be significant.

Interesting Facts about CryptoCurrency

There are various facts about Cryptocurrency when we look back to the history of Cryptocurrency. Some of the shocking and some of them make us laugh. After reading the history of Cryptocurrency, let’s make your mind fresh by reading some interesting facts about Cryptocurrency.

1. Bitcoin founder – Mysterious Person Satoshi Nakamoto

Satoshi Nakamoto published Bitcoin – A Peer to Peer Electronic Cash System in 2008, and after that, work on bitcoin started. Still, no one knows who Satoshi Nakamoto is; Satoshi may be an individual or group of individuals, the real identity of Satoshi Nakamoto is still mysterious to the world.

2. Limited Number of Coins Exist

Unlike the Fait currency, the total maximum circulation of Cryptocurrency is limited and defined before the launch. Because of fixed circulating volume, there is always a limited number of coins that exist.

3. Impossible to band Physically

Cryptocurrency is not real money and has no physical form; it exists in digital or virtual form only. Because of its digital existence, no one can ban Cryptocurrency physically. To bank Cryptocurrency, every institution/ government makes a change on their digital monetary law. The overall conclusion is that no physical form, not possible to band physically.

4. There are over 7,000 cryptocurrencies.

Long away from the starting of the first Cryptocurrency, Bitcoin, today (at the time of writing this article), more than 7,000 cryptocurrencies exist, according to Coinmarketcap.

5. The first bitcoin monetary transaction is Pizza. ( World expensive pizza ever)

In mid of 2010, a US Citizen from Florida state, Mr. Laszlo Hantecz buys a couple of Pizza for 10,000 BTC. This is the first commercial transaction of BTC and the worth of two pizzas in today’s price (at the time of writing) is more than $550 Million that is enough to buy a pizza franchise more than hundreds of times.

6. Excavate land and search trash yard for bitcoin.

In 2013, Wales Citizen/ British Citizen James Howells through its hard drive with 7,00 bitcoin mining. After realizing the price and potential of Bitcoin after some year, he was searching the drive. He was trying to convince his local city council to allow him to excavate the dump yard for exploring his hard drive. He also offers a particular portion of his bitcoin profits to the authority if they enable him to look on the trash and excavate the dump yard.

Also read: Interesting Facts about the United Kingdom

7. Some cryptocurrencies are not just coins.

We usually consider cryptocurrencies are the crypto coins, but cryptocurrencies are more than coins. Blockchain 2.0 is also known as smart contracts and is used to verify, control, and execute an agreement. Smart contracts are used primarily in investing, lending, trading, and borrowing activities in Cryptocurrency.

8. Term “Gas” used in Crypto transaction

In the crypto market, the transaction fee is known as Gas. Gas is the transaction fee that is required for the successful completion of transition on the Ethereum network.

9. CryptoKitties first blockchain games

The first blockchain game is CryptoKitties. In CryptoKitties, you can breed your digital cats. CryptoKitties you own is not currency. It is NFT (non-fungible token). NFT is the second extensive application of Blockchain after Cryptocurrency. CryptoKitties game is built on Ethereum based Blockchain.

10. Expensive CryptoKitty Ever

In 2018 someone sold their CryptoKitty Dragon at 600 ETH. This is the most expensive digital cat in the CryptoKitties game. In today (at the time of writing), the price of that NFT crypto kitty Dragon is more than $27 Million (today’s exchange rate is $4536 for 1 ETH).

11. NFT aren’t coins

NFT is the second widely used application of Blockchain, but NFT is not a coin. NFTs are a token that cannot be divided or replicated. NFT are the description of a particular asset and called collectibles.

12. Cryptocurrency started as a Joke – Dogecoin.

One of the wells know Cryptocurrency in the market is Dogecoin, but the starting developer started Dogecoin as a joke. After the success of bitcoin, there were numerous coins on the market and at that time developer of Dogecoin made a joke coin using the surprised-looking dog as a symbol. Dogecoin was a popular meme in 2013 and 2014, but after that, people considered Dogecoin as a potential coin in the market.

13 Highly Volatile Assets

All we know and we have various real-life examples that crypto makes some people millionaire/ billionaire, and at the same time, some people lose everything they have just because of a high drop in the crypto market. So Cryptocurrencies are considered highly volatile assets.

14. No Fundamental backing (Decentralize)

Unline real money, Cryptocurrency has no fundamental backing. We know that every country’s currency is backed by the government and center bank, responsible for circulation and monitoring it. No such support is available on Cryptocurrency; that’s why it is called decentralized currency.

15. Limited knowledge among the investor

Though trading and investment trends are at their peak, there is limited knowledge about Cryptocurrency. More than 60% of the investors are there to profit from crypto because their friends or family members earn from crypto.

16. About 20% of BTC had already lost.

According to data, 20% of the total BTC supply (equal to 3.76 Million BTC) has been stuck or lost and cannot access. If you wonder that how that’s possible, there may be various reasons. 1.1 Million BTC is held by creator Satoshi Nakamoto and never used, and people believe that Mr. Satoshi will never use these coins in the future. Sadly some people live in this world without sharing their wallets access. Some people lost their security phrase or keys.

17. Legal Tender in Some country

Due to the increasing popularity of Cryptocurrency and potential future countries, think about making a crypto legal tender of their country. In this race, El Salvador is the first country that makes BTC legal Tender for their country, and Cuba is the second country that makes Bitcoin a Legal Tender for their country.

18. Wait until 2140 to mine the last Bitcoin.

According to the bitcoin blockchain script, there is only 21 million bitcoin produced in lifelong. This makes the total supply limited already mentioned on the script. 18.8 million BTC have already been mined, and some of them have already been lost. And we know that the mining reward is half every four years, and the process is called the halving. According to the calculation and halving process, Miners can only mine the lass bitcoin after 120 years. So the last BTC mining time is 2140. What an interesting fact that we need to wait more than 120 years to see the last Bitcoin.

Some FAQs related to Cryptocurrency

Q. How Distributed Ledger Technology (DLT) and Blockchain Technology work?

Ans: Distributed ledger Technology is the security protocol that governs the secure functioning of the digital database on a decentralized system. The distributed networks delimit the need for the central authority to keep checking against manipulation. DLT works on a cryptography algorithm that stores all information is secure and accurate ways. Once the information is stored, we must need keys to access the information, called cryptographic signatures.

You are accessing DLT for storing the information and retrieving the data by communicating with the help of a private key and public key to complete the transaction in Blockchain technology.

Q. What is Cryptocurrency?

Ans: Cryptocurrency is the digital form of currency secure by blockchain technology using cryptographic encryption and decentralized. Cryptocurrency and transactions on Cryptocurrency are secured and managed by Distributed Ledger Technology along with blockchain technology.

Q. Why is Cryptocurrency so popular?

Ans: The popularities of cryptocurrencies is governed by various factors that are

- Decentralized currency and has no interference of government and government bodies.

- High potential for future profit

- Easy to use, manage and transfer Cryptocurrency where we have too many difficulties while managing and transferring fiat currencies from one nation to another.

- Highly secure, and no one has access to your funds.

Q. Why is Cryptocurrency called ‘virtual money?

Ans: Cryptocurrency has no physical forms; we buy, sell, hold in digital formats, so most of us call Cryptocurrency “virtual money” or “digital money.”

Q. How was Cryptocurrency invented?

Ans: People talking about cryptocurrencies from the late 90s, but its discussion was at its peak when the USA financial crisis disturbed almost all the world. After the financial crisis in 2008, an unknown mysterious person Satoshi Nakamoto released a paper about digital money named bitcoin. Later he developed Bitcoin, and bitcoin ruled the world; if you need to know more about bitcoin after 2008, please read the history of Cryptocurrency mentioned above.

Q. What is First Cryptocurrency?

Ans: Bitcoin is the first Cryptocurrency. Although in the late 90s, people were thinking about crypto, they never launched, and the project collapsed in under developing phase.

Some Terms related to Cryptocurrency

Cryptocurrency is new to this world, and before 2008 almost all people on earth don’t know what Cryptocurrency is. In the history of Cryptocurrency, people define new words as per their requirements. So to understand cryptocurrencies in-depth, you need to know some terms related to the crypto industry, listed below.

Address

The Address is the string consists of alphanumeric characters. Using Address, people can send, receive, and store Cryptocurrency. Address in Cryptocurrency is working similarly to our physical address. We use our Address to receive and send emails and store valuable something on our house address in real life.

Altcoin

We know that Bitcoin is the first digital asset, and all the coins developed after the Bitocin are known as Altcoin. An altcoin is directly referring as an alternative coin to the market king Bitcoin.

Bitcoin

First invented Cryptocurrency and the king of the crypto market since its starting.

Bitcoin Cash (BCH)

BCH was the variation of Bitcoin after it forked from Bitcoin in 2017.

Bitcoin Maximalist

A person who believes bitcoin is the only valuable Cryptocurrency is called Bitcoin Maximalist.

Blockchain

Combination of series of blocks that kept records of all the transactions made on the blockchain.

Blocks

A combination of blocks made blockchain. Blocks work as fundamental units in blockchain that record all the transaction details until the block is full.

Coin

The coin is a synonym of currencies in the crypto market. Coins are the tangible assets that store in blockchain.

Coinbase

One of the most popular centralized crypto exchanges. In 2021 Coinbase was listed in Nasdaq and became the first crypto exchange that goes to the public.

Cold Wallet/Cold Storage

The cold wallet is a secure way to store crypto in offline storage. Coldwell is also known as hardware wallets like the USA, a hard drive that safely keeps our Cryptocurrency and protects us from hackers.

dApps (Decentralization Applications)

dApps is the short form of open source decentralization application based on blockchain technology. There is known as the origin of dApps, and some actual-world use of dApps are games, social media, the initial offering of the smart-contracts-based crypto app, and more.

Decentralization

Decentralization is the process of distributing power and control away from the central authority. All the users have equal ability to control and handle the platforms in a decentralized system.

DeFi (Decentralization Finance)

Smart-contracts-based financing activities without involvements of any types of intermediatory person or institutions are called DeFi.

Digital Gold

In the real world, the price of the different currencies is evaluated based on gold. Similarly, in the crypto market, many investors treated BTC as digital gold and analyzed the cost of another crypto based on BTC.

Distributed Ledger Technology (DLT)

Distributed ledger technology is the security protocol that governs the secure functioning of the digital database on a decentralized system. The distributed networks delimit the need for the central authority to keep checking against manipulation. DLT works on a cryptography algorithm that stores all information is secure and accurate ways. Once the information is stored, we must need keys to access the information, called cryptographic signatures.

Ethereum

Second most significant Cryptocurrency by market capitalization. Origins of Smart contracts and dApps.

Exchange

Exchange is the marketplace where you can buy, exchange, and sell your holdings.

Fait

Fiat currency is a centralized system-managed currency that is backed with no commodity. The price of Fait currency relies on trust on center authority (government and center bank) who regulate and manage monetary policies.

Fork

When there is a need to change the law on the blockchain, and not everyone agrees to the same conclusion, there are two possible paths on blockchain: some follow the new rule, and some follow the old law. The fork is the splitting in the rule. This splitting into two groups creates separation on blockchain leads to investment in Bitcoin Cash and Ethereum classic.

Gas

The term “Gas” refers to the fee that the user or miner must pay for completing the transaction blockchain network.

Genesis Block

The world’s first block of BTC cryptocurrency ever mined.

Halving

Halving is the process of halving the reward given to the miners by using some resources as previously. In Bitcoin, script halving occurs every four years.

Hash Rate

Hash rate is the measuring unit that measures the use of processing or computing power while mining. Higher the computing and processing power, the higher the hash rate, and the higher the mining reward.

Hot Wallet

A hot wallet refers to the software-based crypto wallet that is always connected to the internet to access cryptocurrencies easily. A hot wallet is similar to a current account in the physical world.

ICO ( Initial Coin Offering)

ICO is the way to raise funds for a new cryptocurrency project. Initial coin offering is similar to IPO in the stock market.

Mining

Mining is the process of generating new crypto coins by solving complex computational problems. High power computers are needed to solve complex mathematical equations, and on successful completion, the miner is rewarded with a certain amount of coins.

Node

A computer or electronic device that connects to a blockchain network.

NFT (Non-fungible Token)

NFT is not a coin; instead, people love to say NFT is a token used to represent digital assets’ ownership. The Ethereum blockchain first starts NFT.

Peer-to-peer

Direct interaction between two users without involving an intermediary of a third party.

Public Key

The public key is the wallet’s Address, similar to the account number in the physical world. With the help of a public key, you can send and receive money from your wallet.

Private Key

The private key is the encrypted code that allows others to directly access your Cryptocurrency, similar to a bank account/wallet password. It would be best to store your private key without private key securely; you may lose access to your funds in the future.

Satoshi

Satoshi refers to Bitcoin founder Satoshi Nakamoto’s first name and refers to the smallest unit of bitcoin. In 1 bitcoin, there are 100 million satoshis. That is, if you have one satoshi, then your worth in bitcoin is 0.00000001 BTC.

Smart Contracts

The blockchain-based algorithm runs specific contracts automatically based on their pre-requirements condition.

Stablecoin

Stable coins are cryptocurrencies that price is backed by outside assets and more stable on their price. Tether, USD coin, Binance USD are some examples of stable coins.

Token

The token is the unit of digital money on the blockchain.

Vitalik Buterin

A computer programmer invented the Ethereum blockchain in 2015.

Wallet

The wallet is the storage of your crypto assets, either coin or NFT, just like a bank account in the real world.

Whale

Whale term is used to represent the big investors who hold a large number of bitcoin. Currently, there are around 2000 Bitcoin whales. And according to Bitcoinplay, three whales hold over 100,000 BTC and 108 whales have 10,000 BTC.

Conclusion

In conclusion, My main motive for writing this article is to provide you the information related to the history and growth of Cryptocurrency in one place. Here in this article, I am covering the history of Cryptocurrency and the history of regular currency. Here I cover all the History Of Cryptocurrency From Starting to Now, along with some interesting facts and incidents related to Cryptocurrency, and define some terms that you need to know before entering the crypto universe. And making this cryptocurrency history article interesting, I am also providing you with some interesting and funny facts and incidents related to Cryptocurrency.

If you love this history of Cryptocurrency, and this article may add value to your knowledge database, please comment on us. We are always happy to hear from you. Your comment is our motivation. Thanks for reading my hard work, and so glad to see you again in my next article. Bye-Bye.

Thank you for this article. This article is very informative. Really love this article. I think this article clear all the thought about cryptocurrency and give overall knowledge about cryptocurrency from the beginning to till now.

Thank you for your appreciation and kind words